Blahnik, Prchal & Stoll Blog

Can't We Just Agree?

Author: Adam Blahnik

If you reach an agreement with your spouse (or ex-spouse) or the other parent to your children regarding custody, parenting time or child support, it is important to make that agreement a binding stipulation and order.

Spousal Maintenance: Who Pays the Taxes?

Author: Adam Blahnik

Are you paying or receiving spousal maintenance? Or, are you in a divorce where spousal maintenance is at issue? This article provides a summary of the tax consequences on spousal maintenance payments that you make or receive.

Holiday Parenting Time Disputes

Author: Adam Blahnik

How to avoid problematic disputes with parenting time schedules for the holidays.

An Award of Attorney's Fees in Minnesota Divorce and Family Law Proceedings

Author: Adam Blahnik

Situations when the Courts order one spouse to pay to the other spouse attorney’s fees as part of their divorce or other family law proceeding.

Marital House: Should I Stay or Should I Go?

Author: Adam Blahnik

Factors impacting the decision on whether to stay or leave the home during a divorce can involve child custody issues and whether there is equity in the home.

Should I Get a Divorce?

Author: Adam Blahnik

The decision whether or not to get divorced is a very difficult one. A divorce attorney will give you advice on your legal rights in the event of a divorce, but should not necessarily be giving you advice on whether or not to get a divorce in the first place.

Property Division: What Can I Keep & What Must be Divided?

Author: Adam Blahnik

An explanation of marital property and non-marital property and how it is allocated in the event of a divorce

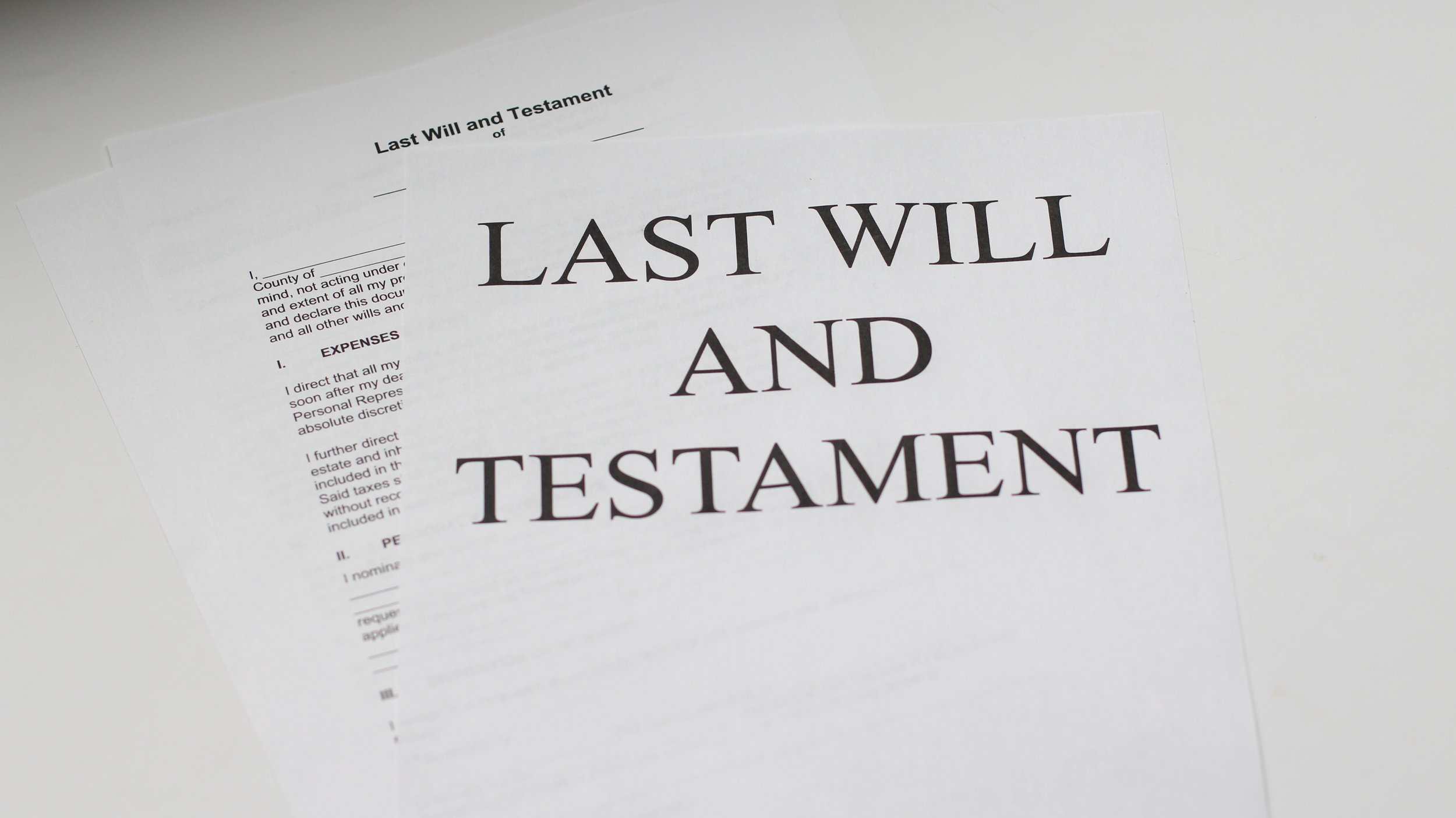

Do I Need a Will or a Trust?

Author: Kim Prchal

An overview of the decision to create a Will or a Trust as part of your estate plan.

Minnesota Parenting Time & Child Support Laws Effective 2018

Author: Adam Blahnik

Effective 2018, every overnight (or overnight equivalent) of parenting time that each parent has with the children matters for purposes of determining an appropriate child support obligation.

Minnesota Child Support: How Much Do I Have to Pay?

Author: Adam Blahnik

The basics of how child support is currently computed in Minnesota and an overview of the changes in the child support laws over the last few decades.